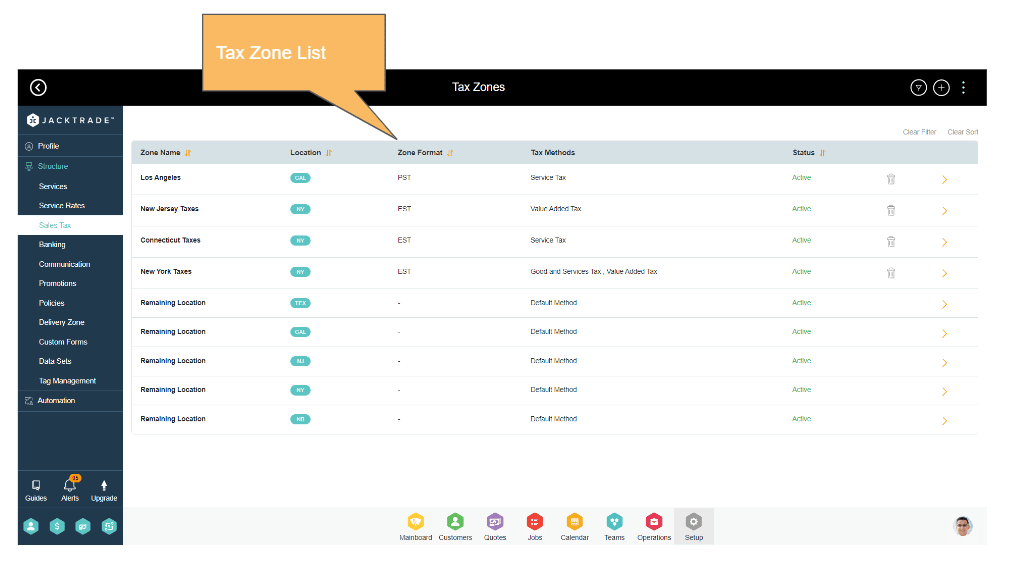

Tax Zones

Tax is generally applied to transactions based on the geographical location where it takes place. Tax zones define taxes you apply where geographically you are selling your services or your product. If your business is selling in an area where taxes have to be included, the tax zone list should have that zone defined.

Here’s an example. Let’s say you live and/or sell in Columbia, South Carolina. You sell a taxable product to a customer in Chesterfield, SC. According to the State of South Carolina Department of Revenue, you are required to charge that customer 8% sales tax. That 8% is the sum of the state rate of 6% PLUS a 2% local tax.

Jacktrade supports setting up tax zones per country, state, and city.

- Every country can be in different tax zones.

- Every state in the same country can be in different tax zones.

- Every city in the same state can be in different tax zones. (metro city/non-metro city).

Taxes are matched to more specific zones - see tax zones matches for further reference.

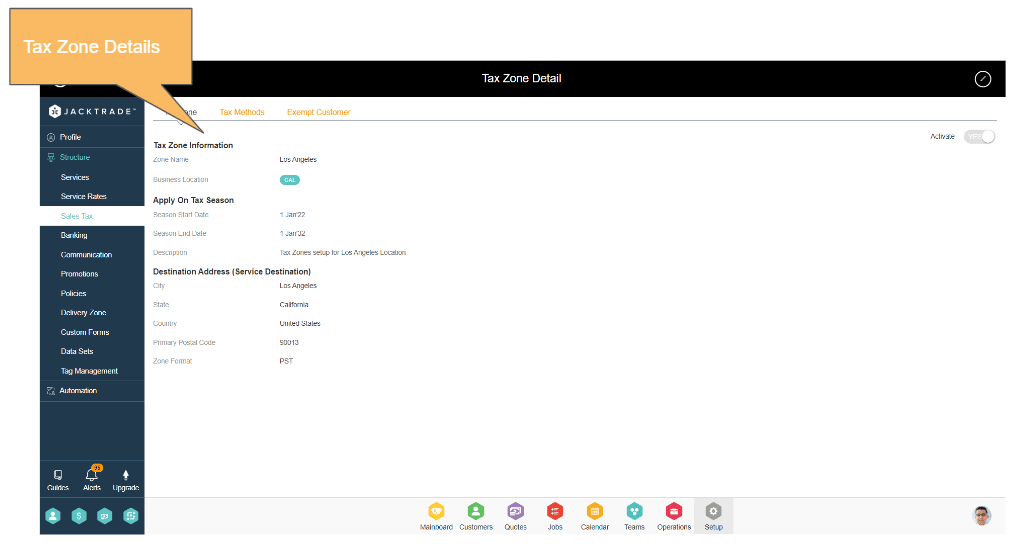

Tax Zone - Details

Tax zone details cover details of the zone taxes that should apply. The tax zone is defined as follows:

-

- Zone Name - Name of the zone. It is recommended to set up unique names to identify your zones easily.

- Zone Description - A simple description of the zone.

- Business Location - A business location of the tax zone as set up in the business settings. This is used as the origination address to look up any associated Tax Zones.

- Apply On Tax Season - Tax season dates help in cases businesses need to apply taxes according to the fiscal year. In case there are tax changes, Quotes and Jobs can continue to refer to old tax years and businesses can build new rules for the upcoming tax year.

- Destination Address - The destination address of the service is matched with the zone destination address to apply taxes. This includes the following

- State - Name of the state to match the destination address. Leave blank (*) to apply to all states.

- City - Semicolon separated the list of cities for the rate. Leave blank (*) to apply to all cities.

- Country - Name of the countries to match the destination address. This cannot be left blank and setting up a country is mandatory.

- ZIP/Postcode – Postcodes for the zone are defined with the following functionality

- You may separate multiple values with a semicolon (;)

- use wildcards to match several postcodes (e.g. PE* would match all postcodes starting with PE),

- use numeric ranges (e.g. 2000…3000)

- leave blank (*) to apply to all postcodes.

Note: Entering no data, defaults to * which is a wild card to permit all in the zone.

Tax Zone - Tax Methods

Each Tax Zone can have multiple Tax Methods which helps businesses to configure multiple taxes as needed when selling their Services and Products.

More details of specific Tax Methods are listed in this document.

Tax Zone - Exempt Customers

There are cases where non-profit businesses are exempted from Sales Tax. The Exempt Customer tab sets up certain buyers from all tax exemptions. Businesses can control the tax-exempt status of each customer on a case-by-case basis.

Jacktrade tax exemption lets you configure specific customers to be tax-exempt. When a customer has this status they are not charged tax for anything they buy, nor are they taxed for delivery. The policy is applied per Tax Method and you can set any customer as tax-exempt by adding a customer to the tax method within the zone.

Exempting Customer From Multiple Methods

In case there are multiple methods in the tax zone, then you will have to add the customer to each method individually. This helps when you want to exempt a customer from only a selected set of your defined tax types. This is managed by how you configure tax methods.

If you have configured more than one type of tax you can selectively set a user to be exempt from some of those tax types, or all of those tax types.

Note: Jacktrade does not handle the collection of tax exemption information. Businesses can handle that however as they see fit. For example, some sites like to add a page with a form where customers can request tax-exempt shopping status. An admin then receives the form data, reviews the request, and decides whether to grant the tax-exempt shopping status, where the admin might need to add an exemption in the tax method. Other businesses handle the process manually for existing customers that they already have a relationship.