Tax Methods

Tax Method Details

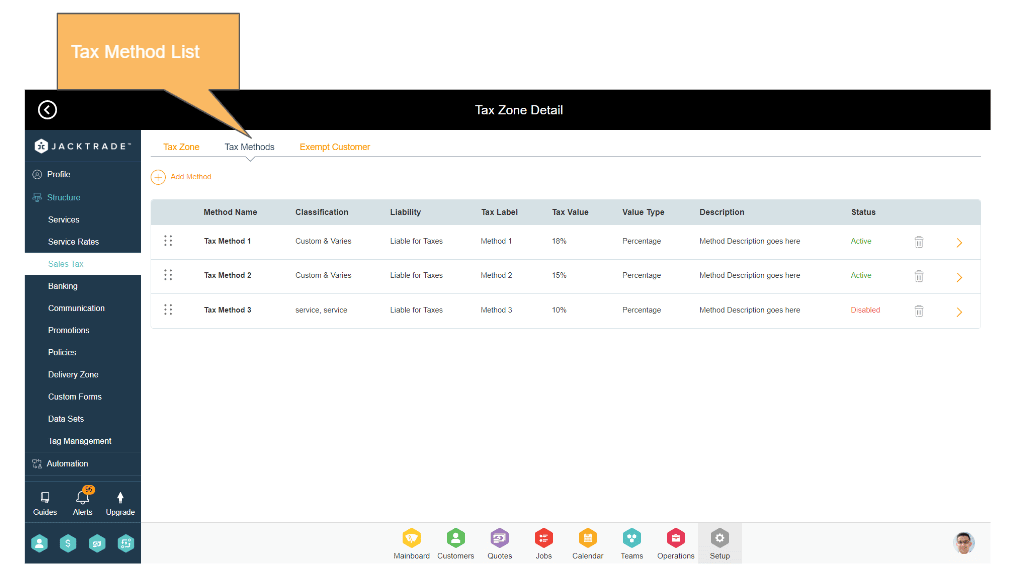

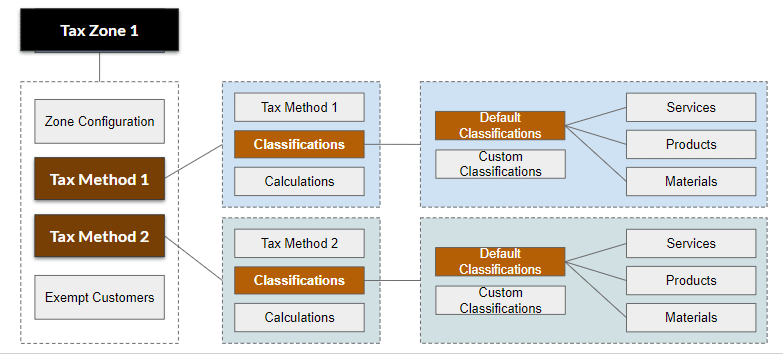

Tax Methods are the primary way how you will configure to apply taxes to “Business Products”. Tax Method is set up with Tax Method details, Business Product classifications, and Calculation configuration.

- Tax Method Name - The name that the user wants to give this tax method name.

- Tax Method Description - A simple description of the tax method.

- Tax Type Label - This is a label given to the tax type by the user and shown in the tax summary and invoice in Quotes / Jobs. Some different types of taxes are listed in tax classification settings:

- Flat tax

- VAT

- Service tax

- Tax

- GST

- FICA tax (Federal insurance contribution act)

- Sales tax

- Excise duty

- Tax Type Code - The tax classification code is derived from the classification codes list. Jacktrade seeds the following classification codes VAT, CST, LST, and SALES.

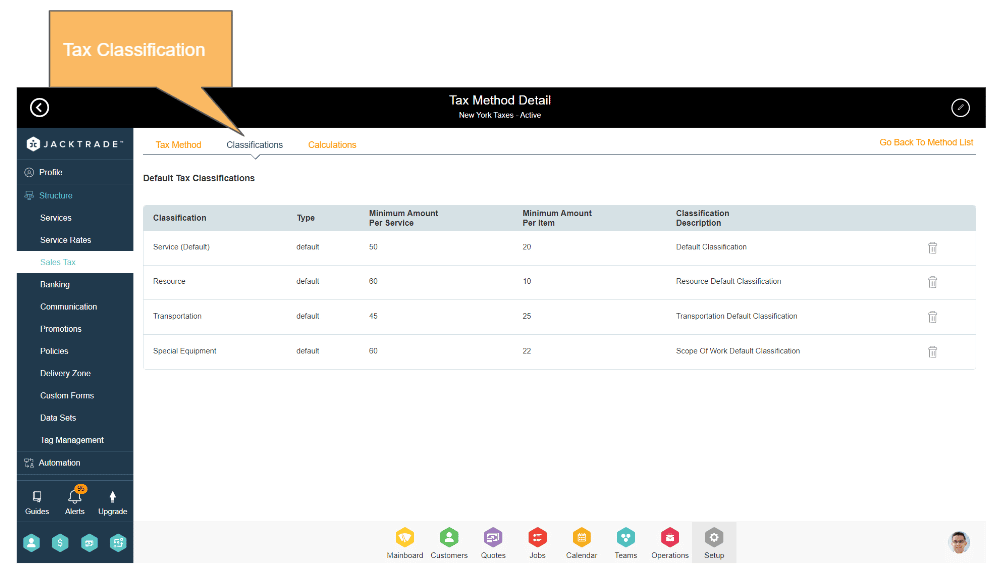

Tax Classifications

Many countries and states apply taxes to services and products differently. For example, in New York, certain software or professional services do not have sales tax associated with them, whereas taxes are applied when selling particular types of products.

Classifications are a way to define how you want any of your services, products, or materials to be taxed for sales or usage (rent, etc). Jacktrade by default supports ‘Default Tax Classifications’, and users can self-define their own classifications

Note - Assigned classifications overwrite default classifications. For example: if product A is classified as Tax-exempt in the tax method, then it will only apply tax methods that have that specifically assigned classification, otherwise, it won’t be a match to any methods resulting in ‘0’ (zero) tax rates.

Default Tax Classifications

Jacktrade supports Independent or collective tax calculations for Services, Products, and Materials. In Quotes and Jobs, taxes are calculated independently for these functions and shown as a summary in the invoice. Business Product Classification is set as follows:

- Services - Taxes are classified in the services in the business settings per business location.

- Resources

- Transportation

- Scope of Work

- Simple Estimates

- Additional Services

- Product / Material - Delivery Method

- Product / Material - Instructions

- Product / Material - Additional Services

- Products - Setup in products and inherited by all associated SKUs. Bundles and Packages do not have tax classification directly, they also inherit the taxes based on the products belonging to them.

- Materials - Setup in materials and inherited by all associated SKUs. This is true for both regular materials as well as rental materials.

Custom Tax Classifications

Tax Classes are assigned to your Services, Products, and Materials. In most cases, you want to use the default tax classification. If you sell goods that require a different tax class (i.e., Tax, except zero-rated products) you can add the classes here. To get started, we include standard and zero-rate tax classes.

Custom tax classifications can be assigned to any of the business products.

- Services - Taxes are classified in the services in the business settings per business location.

- Resources

- Transportation

- Scope of Work

- Simple Estimates

- Additional Services

- Delivery Method

- Product / Material - Instructions

- Product / Material - Additional Services

- Products - Setup in products and inherited by all associated SKUs. Bundles and Packages do not have tax classification directly, they also inherit the taxes based on the products belonging to them.

- Materials - Setup in materials and inherited by all associated SKUs. This is true for both regular materials as well as rental materials.

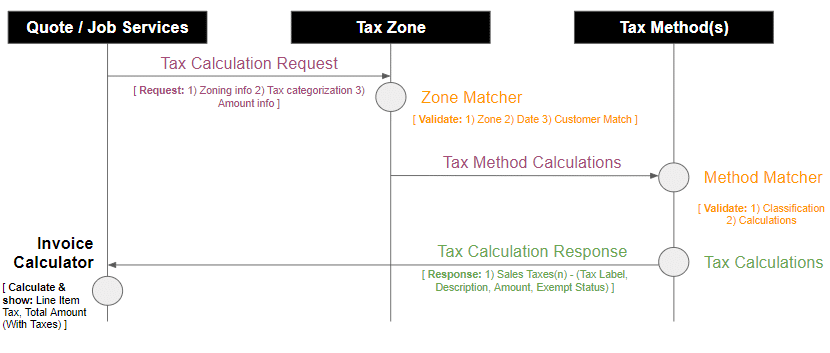

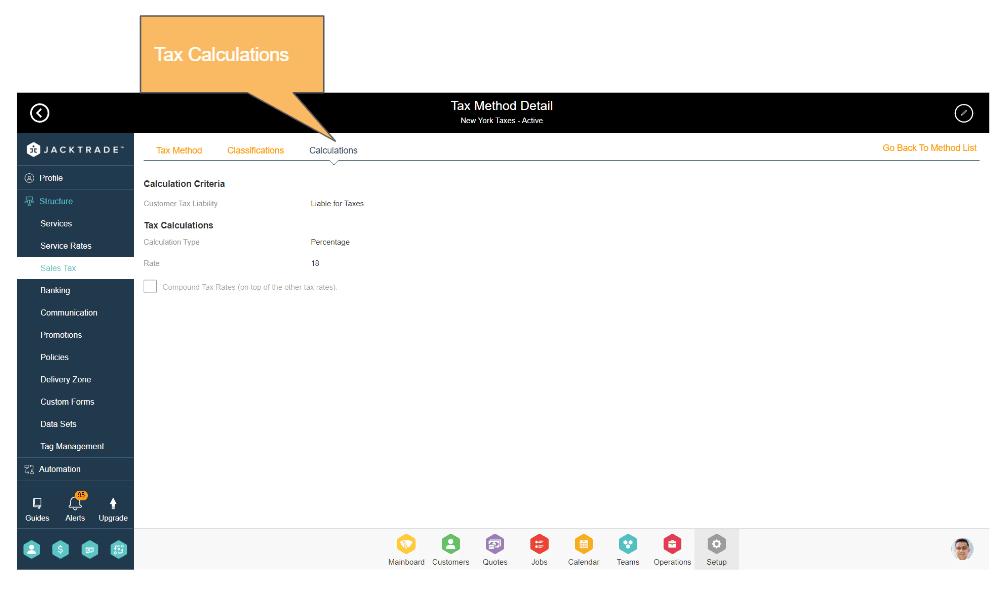

Tax Calculations

Taxes are calculated based on the destination address of the services. Users can choose to set up how they want the taxes to be applied in the business.

Calculation Criteria

Customer Tax Liability - The customer classification code is set to either

- Tax Exempt - Taxes are calculated by the exemption. The exemption label is not written in the invoice, tax is simply calculated in Quotes or Jobs as 0. For example, Most food is exempt from sales tax in New York. The exemption for food includes food products; dietary foods; health supplements; and certain beverages.

- Liable for Taxes - When customers have to pay taxes on Services, Products, or Materials.

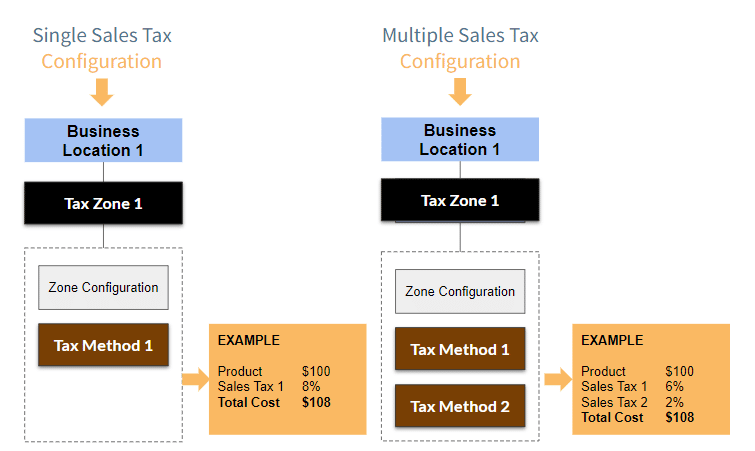

Tax Method - Tax Calculations

Taxes are calculated for each matched zone

- Calculation Type - Flat or percentage type can be defined for rate calculations.

- Rate - Enter the tax rate, for example, 20.000 % type for a tax rate of 20%. Rates can be set for 3-digit decimals for deeper accuracy.

- Priority - Priority for this tax zone is set with drag and drop of the Tax Zones in the Tax Policy. Only 1 matching zone per priority will be used. To define multiple tax zones for a single area the system specifies a different priority per zone. This is dependent on how the zone is sequenced by the user.

- Compound - If this rate is compound applied on top of all prior taxes check this box. Prior taxes are the taxes with higher priority in the same exact zone as this one.

- Delivery - If this rate also applies to delivery, check this box. By default, the delivery cost is not considered as part of the total to apply taxes. Delivery only applies to products and materials.

- Apply Tax Post Minimum Price - This applies taxes after the minimum price is set. For example, a value of $150, with ‘apply tax post minimum price’ set to $100, will apply taxes to $50 only.

- Note - A description is written in the invoice if this criterion is met based on the flag set in the configuration. By default, this flag is turned on when adding a new tax zone.