Applying Taxes in Quotes & Jobs

Applying Taxes Dynamically

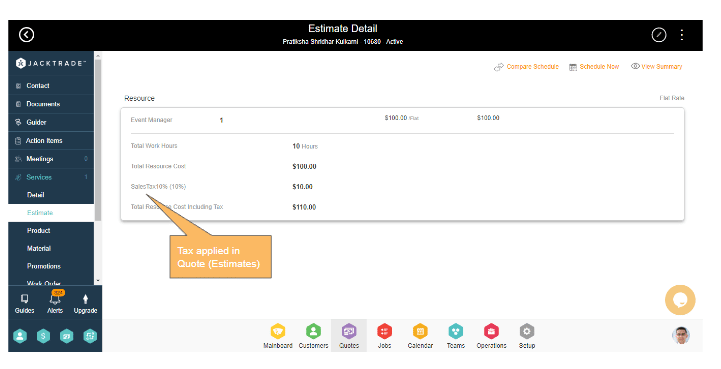

All taxes are applied dynamically by default in Quotes and Jobs. Sales Taxes are applied when there is a cost structure that is added to either Estimates, Products, and Materials.

Taxes are applied to any cost post-promotion is applied. Taxes are applied to services, products, or materials independently. These classifications have to exist in the Sales Tax setup for it to apply.

Applying Multiple Taxes

Multiple taxes are allowed per Tax Product as long as there are multiple methods that match the criteria within the Tax Zone.

Showing Independent and Summary Taxes

Example - Tax Calculations Summary

CGST (4.50%) Rs 400.59

IGST (4.50%) Rs 400.59

Paper Tax (Flat) Rs 29.00

Total Taxes Rs 830.18

(Dynamic - Zone Name)

Delivery Methods - Classify services taxes in Business Settings where ‘Delivery Methods’ are set up per location.

Applying Manual Taxes

All taxes are applied dynamically by default. You can also apply taxes manually per Quote or Job. Taxes applied manually via a particular Submit screen only applies to all the services in that Quote or Job.

Taxes are applied to the entire cost of the quote and not applied specifically to products and services independently.

Additionally, manual taxes can be saved per business location and applied in the quotes and jobs specific to that location.

Handling Change Management

Sales taxes are a crucial part of business operations and it's vital to get Sales Taxes right. In most cases, once Sales taxes are set up properly, they usually don’t need to change unless sales tax policies and rates change.

So, what happens when you change Tax settings? Well, there are two scenarios:

- Functions that are not using Tax policies yet at all.

- Entire or some part of the policies were changed: For example,

- Tax zones and methods, and classifications were changed with data from Quotes and Jobs referencing these tax policies.

- The Tax Zone was not changed but the Tax Methods were changed.

- Tax Methods were not changed, but Exempt Customers in Tax Zones were changed.

Changing Tax Policies

Jacktrade lets you change tax policies as desired and checks if any functions are utilizing the data. The taxes policies data is always applied

- New Services are being added. This will always apply to current active policies.

- Existing services in Quotes or Jobs that are being changed. User consent is requested if data is utilized in order to apply the changes. Dependency is checked across the tax policy, and here are some examples:

- Tax Zones - Changing tax zones - Tax Zones Details, Exempt Customers, Marking Zone Active or Inactive

- Tax Method Details - Changing Codes, Labels, Calculations, Classifications, Tax Methods Sequence, or Marking Tax Methods Active and Inactive.

- Tax Settings - Changing Tax Categories, Tax Classifications, and Economic Data.

Re-applying Taxes After Tax Policy Changed

Re-applying taxes after they have changed is managed both for existing and new data. Jacktrade provides flexibility if you want to retain your older tax policies both in your currently active and archiving functions.

Below we give you an example of how changing policy affects your current data functionality. A similar example is true when changing anything on the tax policy.

Use-Case of Tax Rates Change

Let’s take the example of changing tax rates.

- Using new tax rates

- Update existing services with new tax rates by re-applying taxes to the services. Taxes are applied to estimates, products, and services collectively. If you update one, the tax rate will be updated through the entire service. Each service has to be individually updated unless you are updating Recurring Master Service, which will update all future child services.

- Applying the current tax rate to new services is straightforward and applies most current policies to the services.

- Using old tax rates

- Maintain existing services with old tax rates. In Services, Jacktrade provides an option for you to maintain old tax methods. Old tax calculations are retained until your services are not updated. On any update to the services, new tax settings get applied.

- Apply old tax rates to new services. This is not possible directly as all new services apply current tax policies. If you need to create services with old tax policies, you have to activate old policies, apply to services and again disable the tax policies.

- Maintaining old tax rates

- The way to manage old tax rates is to archive Quote or Jobs entirely or individual services. Completing a service does not mean that you can not re-apply taxes. Only archived functions where the service can not be changed or edited and will continue using tax rates that were applied during the time of the services. Anytime, you can change any cost-related items in Quote or Jobs, taxes will be re-applied based on the current tax configuration.

Business Location Changes In Tax Policies

Location changes in tax policies are not allowed once there is a dependency created.

Example Taxes in New York State

|

Sales Tax in New York Counties |

|||

|

County |

State Rate |

County Rate |

Total Sales Tax |

|

Albany |

4% |

4% |

8% |

|

Allegany |

4% |

4.50% |

8.50% |

|

Bronx |

4% |

4.88% |

8.88% |

|

Broome |

4% |

4% |

8% |

|

Cattaraugus |

4% |

4% |

8% |

|

Cayuga |

4% |

4% |

8% |

|

Chautauqua |

4% |

3.50% |

7.50% |

|

Chemung |

4% |

4% |

8% |

|

Chenango |

4% |

4% |

8% |

|

Clinton |

4% |

4% |

8% |

|

Columbia |

4% |

4% |

8% |

|

Cortland |

4% |

4% |

8% |

|

Delaware |

4% |

4% |

8% |

|

Dutchess |

4% |

4.13% |

8.13% |

|

Erie |

4% |

4.75% |

8.75% |

|

Essex |

4% |

4% |

8% |

|

Franklin |

4% |

4% |

8% |

|

Fulton |

4% |

4% |

8% |

|

Genesee |

4% |

4% |

8% |

|

Greene |

4% |

4% |

8% |

|

Hamilton |

4% |

4% |

8% |

|

Herkimer |

4% |

4.25% |

8.25% |

|

Jefferson |

4% |

4% |

8% |

|

Kings (Brooklyn) |

4% |

4.88% |

8.88% |

|

Lewis |

4% |

4% |

8% |

|

Livingston |

4% |

4% |

8% |

|

Madison |

4% |

4% |

8% |

|

Monroe |

4% |

4% |

8% |

|

Montgomery |

4% |

4% |

8% |

|

Nassau |

4% |

4.63% |

8.63% |

|

New York (Manhattan) |

4% |

4.88% |

8.88% |

|

Niagara |

4% |

4% |

8% |

|

Oneida |

4% |

4.75% |

8.75% |

|

Onondaga |

4% |

4% |

8% |

|

Ontario |

4% |

3.50% |

7.50% |

|

Orange |

4% |

4.13% |

8.13% |

|

Orleans |

4% |

4% |

8% |

|

Oswego |

4% |

4% |

8% |

|

Otsego |

4% |

4% |

8% |

|

Putnam |

4% |

4.38% |

8.38% |

|

Queens |

4% |

4.88% |

8.88% |

|

Rensselaer |

4% |

4% |

8% |

|

Richmond (Staten Island) |

4% |

4.88% |

8.88% |

|

Rockland |

4% |

4.38% |

8.38% |

|

Saratoga |

4% |

3% |

7% |

|

Schenectady |

4% |

4% |

8% |

|

Schoharie |

4% |

4% |

8% |

|

Schuyler |

4% |

4% |

8% |

|

Seneca |

4% |

4% |

8% |

|

St. Lawrence |

4% |

4% |

8% |

|

Steuben |

4% |

4% |

8% |

|

Suffolk |

4% |

4.63% |

8.63% |

|

Sullivan |

4% |

4% |

8% |

|

Tioga |

4% |

4% |

8% |

|

Tompkins |

4% |

4% |

8% |

|

Ulster |

4% |

4% |

8% |

|

Warren |

4% |

3% |

7% |

|

Washington |

4% |

3% |

7% |

|

Wayne |

4% |

4% |

8% |

|

Westchester |

4% |

3.38% |

7.38% |

|

Wyoming |

4% |

4% |

8% |

|

Yates |

4% |

4% |

8% |